10th Chapter | Pay yourself first!

At the edge of the meadow, the babbling brook meandered through the bright fields of grain. Ada sat on a moss-covered rock, her feet submerged in the cold, crystal-clear water, marvelling at how money, like the flowing stream, had the power to feed her imagination and stimulate her curiosity. It was a reminder of the choices she was about to make... to earn money wisely, to save consistently, to invest in her dreams, and, above all, to spend wisely.

George: Hey, you're a dreamer! What are you thinking so deeply about?

Ada: Hi :) I was thinking that all the information regarding financial education encourages saving first and only then spending money. Hypothetically, the process makes sense, but in reality I find it very hard to implement.

George: Well, it's not that hard! I say it's just a matter of willpower, first, and then practice.

Daniel: What are you two talking about here?

Rareș: I'd really like to know how to do this quickly. George, tell us what you know about this topic?

George: Of course! I'm happy to tell you what my mother told me just recently. David Bach, an American financial writer, coined a name for a phenomenon extremely common in almost all people, that of not knowing how much money they spend every day on little things. Hundreds of people from all socio-economic backgrounds, who tracked all their monthly spending during his study, were surprised by how much money they spent on trifles. David called this phenomenon the Latte Factor®.

Ada: Latte? That's funny! You mean that good coffee with milk and sweet syrup at Starbucks? My mom kind of likes it and whenever she's in town she spends 16 lei on a big cup.

George: That's exactly what that latte is, yes. David reckons there are 8 very popular places where our money ˝emigrates˝ every day. I can think of 3 of them now: lattes, cocoa or whatever beverage we like, mobile apps and online shopping. His reasoning is simple and also common sense. He says it like this: because you have the good habit of paying a sum of money (however small) on a guilty or less guilty pleasure, it means you meet the most important condition for saving - the already conditioned behaviour you can use to save every day, not just to buy yourself a cocoa, but also to put money aside.

Ana: Wait, I don't understand! I'm getting a little confused and tangled up in terms!

Daniel: I figured that since I'm in the good habit of buying a bagel every day on my way to school, which I'll give 2 lei for, let's say, I'll take the opportunity and put 2 lei in savings. What do you say, George?

George: You couldn't have explained it better, Daniel! Just imagine! It's easy for us to reach into our pocket for a pretzel. Why shouldn't it be just as easy for us to do the same to save every day? To convince you, I challenge you to do the math together. If we started saving 2 lei every day, how much money would we save in a month?

Rareș: 60 lei

George: Right, and in a year?

Ada: 720 lei

George: Excellent! And in 10 years?

Daniel: If we keep the same amount, 7,200 lei. But I suppose we should also get something for the interest we earn on the 720 lei we save each year.

Ana: Well, come on, I understand the reasoning, but the interest is super low. Don't you see, I save 2 lei a day and after 10 years I only have 7,200 lei?

George: Yes, I agree that it seems like a little money and a lot of effort, but mathematically speaking, if in 10 years the interest was only 2%/year, you would have a sum (made up of the principal plus the interest on the interest) worth not only 7,200 lei but 8,153 lei saved. And at an interest rate of 8%/year, you would have saved 11,265 lei in just 10 years. In other words, you save 720 lei/year, and after 10 years, in addition to your money, you have a surplus of 4,056 lei.

Daniel: Yes, it seems to me a very simple and extremely motivating calculation. Basically, you can save small amounts, which then, invested intelligently in the long term, can generate income for the future.

George: Here's a table that shows us, mathematically, how this rhythmic, long-term saving thing works. My maths teacher showed it to us recently and I find it super helpful, especially as I can do real calculations for the future.

Rareș: What I find cool about this topic is that no matter how much we save, especially at the beginning, we can practice saving every day. Yeeey, I'm going to start today!

Ada: Okay, okay, but how can we save this money and then invest it? I really don't get it! We're still minors, even if some of us have ID.

George: Look, I have an agreement with my parents that motivates me. As you already know, I put 5 lei in the piggy bank every week. At the end of each semester, in July and January, my mother invests in a mutual fund the amount of money I have collected during the year. When I turn 18, I'll be able to do this on my own.

Ana: What is a mutual fund? I'll soon be running for my life if I hear one more mention of a fund George mentions.

George: Haha, you're funny. At first, Ada was also very upset by my ideas. I really do study and consistently apply these financial concepts, because by the time I'm 35, I really will have saved up 1 million in my account. I'm reading a lot of books and working on a personal essay. I really want to become a millionaire.

Daniel: I also know a method of saving, which my older brother started to apply consistently after he attended a financial education course. At the beginning of each week, when my mother gives us our pocket money, he sets aside 20% in savings, 50% for current needs and 30% for wants. This method is called 20/50/30 and at least, for him, it helps him to spread his money out in such a way that he can fund his various whims and not feel guilty about not saving for the future.

Ada: Wow! Very cool idea. But I'm confused. If your brother does this, why don't you do it? It seems very logical, it's easy to remember, and it intuitively divides expenses into 3 broad categories! :)

Rareș: I think I'll apply it soon. I manage to spend all my allowance before my month is up.

George: It is recommended that you do not use your allowance in any instance. It's money you get from the state, just for existing and being a minor. Put it aside as far as possible.

Rareș: I understand, but I couldn't have any other source of income.

George: But the allowance is not a source of income, it's just an allowance. Income is money you get if you perform a service and take on the responsibilities associated with it.

Rareș: Well, what job could I get when I'm 13?

George: I think you can have a small-scale "job" in the household that you could get money for. Look! This is one way my parents encouraged me to "earn" money in return for my investment of time and effort for an expected financial reward. I took it upon myself to take care of the puppy. Not only do I feed and water him, but I clean his litter, walk him regularly and go with him to the doctor for vaccinations or when he is sick. I buy him food and anti-parasite medication. And I take care of him every day.

Ana: I get money from my parents just for being "obedient".

Daniel: Hmm... that doesn't sound good to me. Sounds like you get regular money from your parents just because you choose to conform to certain situations they ask of you! It's a cultural practice that I deeply dislike. In other words, when you're not being ˝ obedient ˝, you don't get money?

Ana: Yeah, something like that. In fact, that's exactly what happens, but what can I do?

George: Experiment with some form of exchange, so that you have more opportunities to adjust your understanding of how to earn money. Offer to take out the trash every day and clean the house or yard, and ask your parents for money for these activities. It will be your first income from which you can then save and spend.

Ana: When I'm not obedient, I don't get any money, and that can even take 3-4 weeks. I'm not bad, but I get into all sorts of mischief, which annoys my parents. And financial punishment is very handy for them. I'd love to be able to save, but what I save when I'm ˝obedient˝ I spend it when I get no money. It's a never-ending situation.

Daniel: I say you can prove them wrong. Only you can choose to change your behaviour to get the result you want.

Ada: I have an idea, which I propose to implement today. I will store at least 80% of my pocket money in a transparent jar. I'm a visual creature and I think I'll be self-motivated to save consistently if I can see myself filling my jar. I'd like to practice my saving behaviour in the recent future as well, and for that whenever I can I'll count the money I've saved up to that point.

George: Excellent idea, Ada. I suggest I join you in the process of setting a future goal that involves saving for a specific purpose: money for fashion design college. That way we can learn together how to use our money to make money and not just think about how we could spend our hard-earned money.

Ana: However, I don't get this idea about now versus in the future. I don't understand the whole choosing between a small reward now and a bigger reward for later thing!

Daniel: Ana, if let's say you're in that period when you're not getting any money and you only have 5 lei available to buy something you need or want, I assume you're focusing carefully on the choice you're making, so you won't be disappointed later. Once spent, the 5 lei "disappears forever" from your personal budget. The same goes for saving!

George: I agree with Daniel. It is essential to understand that in order to buy a more expensive item it is important to save before and only when we have all the money saved we will action.

Ana: Listening to you, I find it very hard to believe that I will achieve what I told you I would do to save. I have no idea how I could "practice" waiting until I have saved the amount of money I will need to buy the item I want or achieve the goal I want, especially if I do something stupid in the meantime.

Daniel: I have an idea! You could make yourself a savings chart, showing how much money you have saved up to a certain point (for example, by colouring the relevant sections on the chart) and how much more you should save (these remain uncoloured until a future point).

Ana: This is a very good idea, I will try to implement it myself. Thanks, Daniel and George for today's savings money lesson.

Rareș: I agree with Ana. However, I still have a dilemma... My only money, as I told you, is my allowance. I've already set the possibility to propose household activities for money to my parents. But, I'm afraid I won't be able to save because I don't know how to not spend all my money in the first 2 days after I get it.

George: I have an idea. I'll tell you a story about my grandparents. In fact, I can imagine that your grandparents do the same. In any case, mine always amaze me. Even though they have a small pension, and most of their money goes on medicines and daily living, every time, absolutely every time, at Easter, Christmas, on my and my cousins' birthdays and even on name days, they give us little presents, which cost money, of course. Still intrigued by this, I asked my grandmother how they manage to have money for these gifts, which we really feel embarrassed to keep receiving. She told me that if we refused the gifts, they would be so disappointed. She also told me that it is very easy for them to put money aside for these little joys. On the day they receive their pension, they put money aside for the burial, for presents for the grandchildren and then divide the remaining amount into four parts, one for each week of the month. This way they manage to have money each month for what they consider important.

Rareș: Hmm... I don't even know if my grandparents do the same with saving, but they give us presents too. I'll be sure to ask them. However, I still have a question. If your grandparents don't have enough money in a week, how do they do it?

George: Very good question! Absolutely never in the current week do they access the money in next week's envelope in advance. They do this in such a way that they can live with the planned money without spending more than they have available.

Daniel: This financial behaviour is inspiring to me! You really got me curious, George. I wonder how this works in my family! I'm going to ask my grandparents and my parents. We've never had a conversation about it.

Ada: George, it seems you've got us all curious. That's a good example. Maybe that's how we learn about financial literacy from our own family too. I'm really glad!

DIARY PAGE | Pay yourself first!

It's a good exercise to make a simple calculation... If you save every day the money for a croissant and a bottle of juice, say 10 lei, in 4 years you have saved about ... ... ... lei.

It may not seem like much for 4 years, but if you were to calculate further, in 10 years that's over ... ... ... ... lei, and in 20 years you will save ... ... ... ... lei.

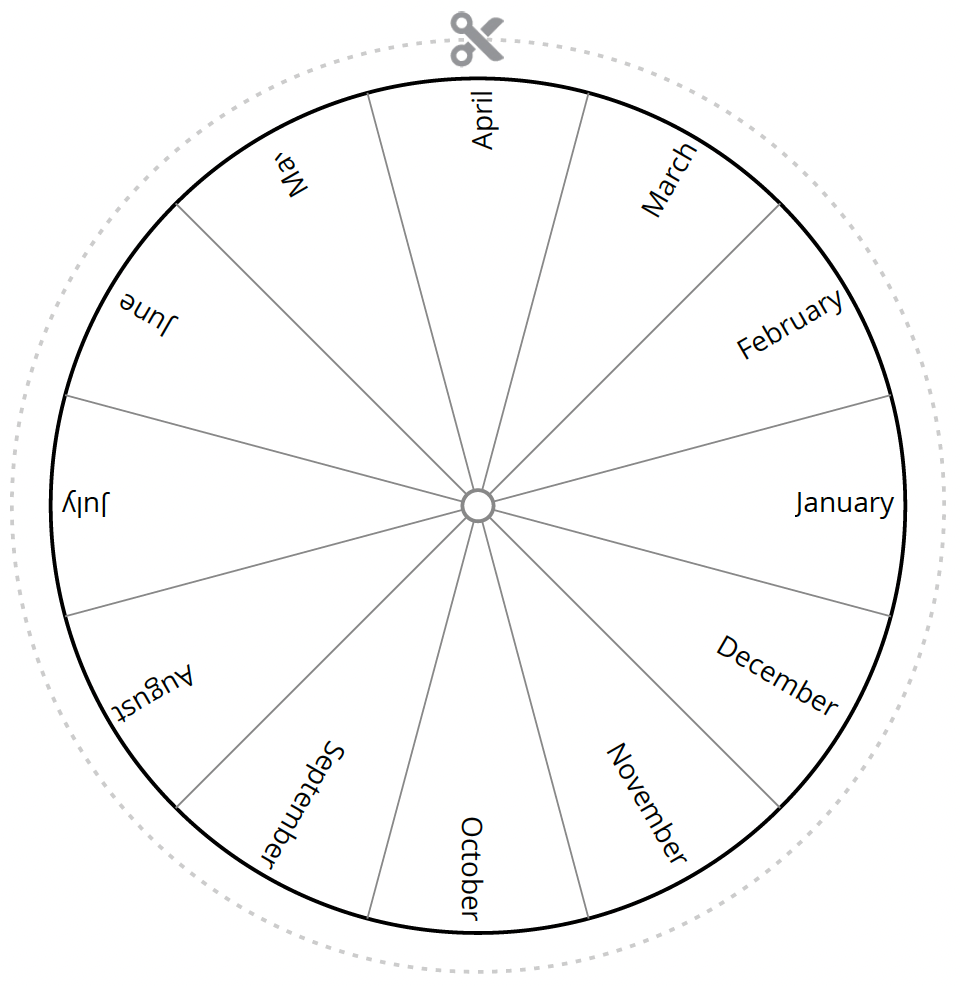

To see how your savings have evolved, create a graph showing the amount of money you have saved up to a certain point. On the wheel below, imagine each segment as having a maximum of 20% capacity for savings each month.

Colour each corresponding segment according to how much you have saved each month: 1% to 20%, as appropriate. Of course, the uncoloured sections on each segment will show you how much you have left to save until some future point.

What do you think, what's going on with your savings wheel? Does it spin or does it get stuck?

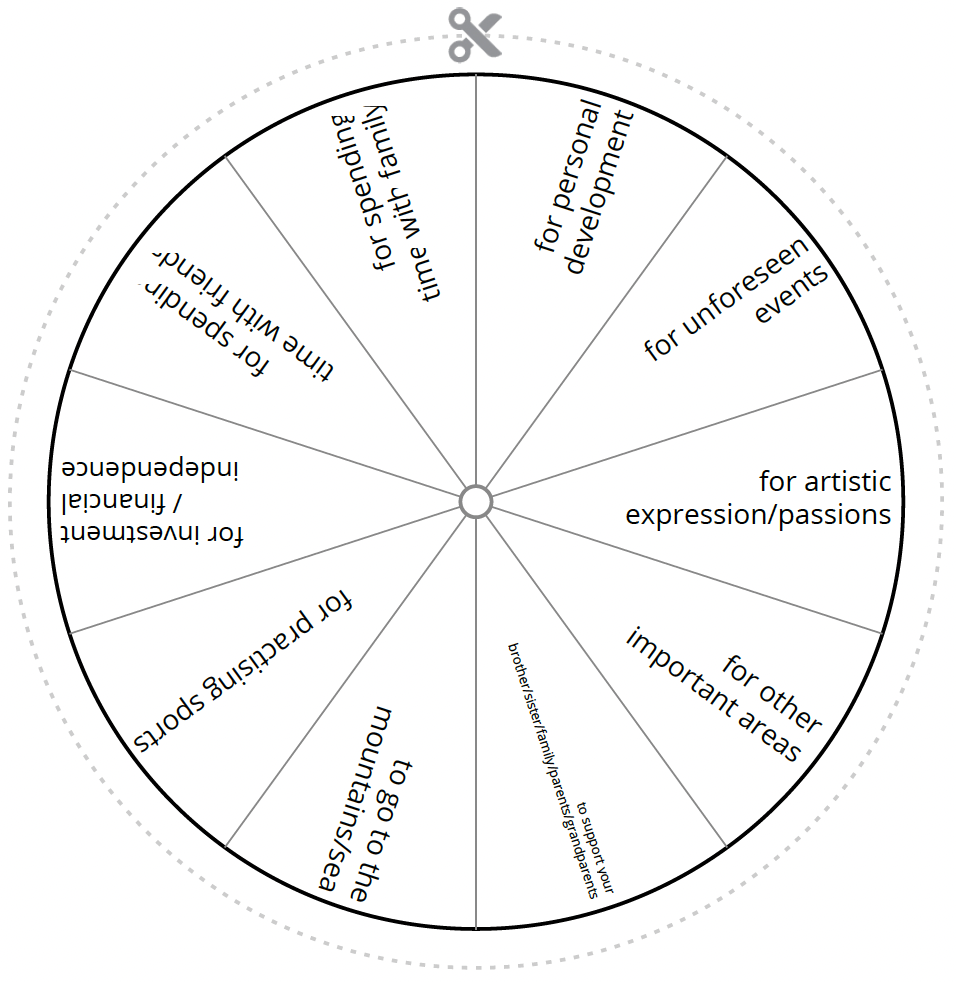

What are the areas of your life that you think would be best to focus on saving more?

On the wheel below, write down the percentage that represents the ideal amount of savings (for each area of your life) that you would like to achieve over the next 12 months from your monthly income.

Now, ask yourself the following 3 questions: How do I divide my savings among the 10 areas of my life? Which area requires consistent savings for the future? What do I propose to do differently?

Did you know that...

There's a misconception that if you want to make a fortune, you simply have to earn more. In reality, things are different - wealth is also derived from how we choose to spend the money we have. But many people have no idea how much money they spend - and this isn't just about the big purchases, it's about the little things, the things we spend money on every day.

Warren Buffet advises us not to save what's left over after we spend, but to spend what's left over after we save.

The Latte Factor© is a way to find out what the big cost of small spending actually is by saving the equivalent of a bagel every day. It could be a cocoa or any other small, repetitive everyday expense: a packet of chewing gum, an orange juice from a vending machine, an electric scooter, the ice cream we crave in the summer months...

Some people have the belief that the 20/50/30 rule applies differentially, depending on monthly earnings, and that may be so. The important thing is to start forming a savings habit. We may not be able to put 20% aside every month, spend only 50% on various food or home maintenance needs, or put 30% towards hobbies and desires. The percentages may vary. At the same time, some people will want to integrate donations and charitable acts into one of these tiers, others will want to invest in education, for example. It remains a personal choice.

These are the first 10 chapters, and the story will continue.

Bạn đang đọc truyện trên: Truyen2U.Com